"All Politics is Local.” ---Former House Speaker Thomas “Tip” O’Neill

The above quote by Speaker O’Neill could not be more accurate. Local politics, or government, is perhaps the most important to us all. It is the decisions made on the local level that can have an immediate impact on our day to day lives and affect our quality of living. We can see where our tax dollars go by witnessing the various Borough operations. We see this every time we see a Police Vehicle drive by patrolling the streets and keeping us safe. We see our tax dollars at work when Public Works is plowing the streets or repairing that pothole. We experience the effects of our tax dollars when we enjoy a day in the park or at the swimming pool. Local government is also the most accessible to all forms of government. What other governing body permit us to see our elected officials walking the streets or at Sunday mass? We know our Borough employees by sight and sometimes know their names. We can stop the Borough Manager in Giant Eagle while he picks up some chipped ham and inform him of an issue (really, I do not mind!). We can easily attend a Borough Council meeting on the third or fourth Tuesday of the month. When was the last time you attended a session of Congress or went to Harrisburg to sit in on a session of our State Legislature? We can actually drive down to the Mayor’s house and knock on his door to talk about an issue. Try that at the White House and see what happens. With all of this accessibility to local government, many are unaware of how much the Borough collects in revenues and spends for these services we have come to enjoy and expect. When I receive a call from a distraught resident over an issue that is very important to them, the first thing they want to be made known is how long they have lived in the Borough. The second thing they stress is that they have been paying property taxes for all of those years and would like to know what their tax dollars are used for. I hope this article is able to answer the perpetual question “What are my Borough Property Taxes used for?!”

All of the figures used in this article are based on the Brentwood Borough 2011 Audit Report. You can find a copy of this Audit on the Borough’s Web Site. In addition, the 2010 U.S. Census has Brentwood with a population of 9,643 (which is an 8% decrease from the 2000 Census.) Let’s begin the conversation with determining how much it costs to operate, maintain, and build an exceptional community. Including all funds (General, Sanitary Sewer, Capital, Highway Aid, and BPI) the Borough spent approximately $7,650,000.00 in 2011. This equates to a per capita value of total spending for 2011 at $793.32. This is NOT how much we paid for these services; it is what was spent on each of us. Now let’s explore how much most of us paid to support these services by paying our property taxes. In 2011 the Borough received $2,654,121.00 in Real Estate Taxes. This includes delinquent Real Estate Taxes collected by the Borough in an amount equal to $238,474.00. Based on this, the per capita cost to each resident in 2011 was $275.24. This is a difference of $518.08 per person. In other words, per capita, we are receiving $793.32 of Borough services for $275.24. Not a bad deal if you ask me. Granted, this does not include Earned Income Taxes that most of pay. Also not all of the 9,643 residents identified in the 2010 are property owners or pay property taxes; this exercise is just a means to demonstrate a cost associated with each resident. For comparison, the City of Pittsburgh per resident outlays are just under $1,500.00 and Liberty Boro, South Versailles, and West Elizabeth spent less than $300 per capita. Overall, roughly 30 municipalities in Allegheny County spent less than $500 per capita.

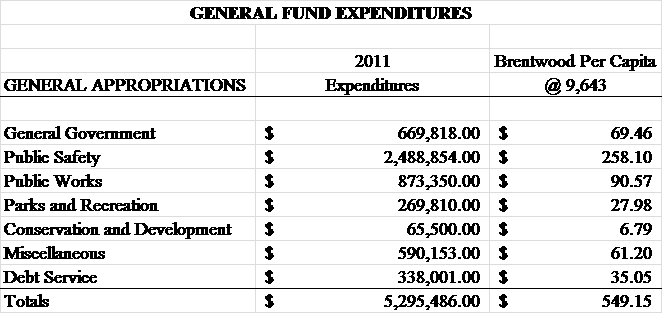

Next, let’s break down the costs associated with various key Borough Services. In 2011, the largest component of total general fund spending is public safety at $2,488,854.00. The category of public safety includes costs associated for police, fire, EMS, code enforcement, planning, and zoning. Remember the Borough has a volunteer fire company and primarily a volunteer EMS. The average per capita amount for public safety is $258.10. So based on the fact the 2011 per capita cost associated with property tax revenues to each resident was $275.24 and the average per capital amount spent by the Borough for public safety is $258.10. To break this down further, let’s forget about any of the Borough’s special fund accounts (Sanitary Sewer, Highway Aid, Park Initiative, and Capital Improvement Fund) and only look at the Borough’s General Operating Fund. The Borough’s General Operating expenses are broken down as follows:

This is what it costs to simply operate the Borough each year. It does include any major capital expenses such as road improvement/paving projects, sewer projects, new equipment, or any major improvements to existing facilities. Remember, in 2011 the Borough only realized $2,654,121.00 in real estate tax revenues. The remaining $2,641,365 revenue needed to cover these General Operating Fund expenditures is made up through other means. Again, an average per capital cost to a Borough Resident of $275.24 for $549.15 of general government services, a nearly 2 for 1 deal, is a pretty good deal. I think it is safe to say that the answer to the question “What are my Borough Property Taxes used for?” should be, “roughly half of what it actually costs to provide such Borough services.” (Of course I would never say that….or I think I just did ?)

Enjoy the wonderful season of fall!

George Zboyovsky, PE

Borough Manager